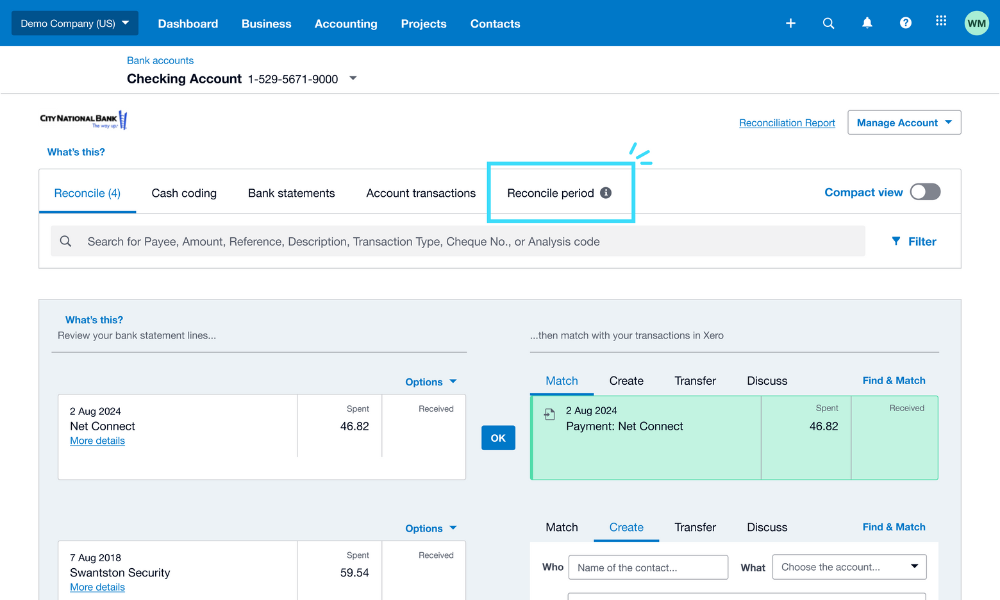

Coming off the year of the US bank feed, I’m excited to share that we’re releasing the eagerly anticipated reconcile period feature in bank reconciliation.

Rolling out now for our US and Canadian customers

Reconcile period enables you to easily compare your bank statement to your Xero accounting transactions so you can:

- define a period with a date range and balance, to easily compare to statement lines

- quickly spot missing, duplicate or incorrect transactions

- confirm completion and accuracy by saving a period when it balances

- protect the transactions for the period from being changed

- create a reconciliation report as a lasting record

Reconciliation is a pivotal step in identifying any discrepancies between a bank statement and the corresponding accounting entries in Xero. Reconcile period is an optional feature that helps you more easily verify the accuracy of your financial data and quickly detect any errors or missing entries for correction.

Start each month with a clean slate

We’ve been listening to your feedback, and understand how important it is for businesses to periodically verify the accuracy of their accounting records, particularly in support of their internal month-end close process. Now, with reconcile period, you can compare your bank transactions and accounting on a monthly basis, and keep a report of the close-out for governance purposes.

This new workflow doesn’t change Xero’s real-time bank rec workflow; it’s an optional addition that can help ensure your accounting is correct. If you’re happy using Xero’s existing bank reconciliation workflow where you categorize and match transactions as you go, you don’t need to change a thing.

Our beta testers love it

We’ve tested the reconcile period beta version with a large group of our accounting and bookkeeping partners, and the feedback has been really positive. Here’s what a few of our testers have had to say:

“Xero’s new reconcile period feature is a game changer. It ensures that each period is properly locked and closed, providing peace of mind. This functionality makes it effortless to stay on top of our customers’ books and, we might add, a bit fun! It’s the kind of enjoyment accountants have when their books are closed correctly.” – Sarah Prevost, Accountant, Mintage Labs

“Xero’s reconcile period has been instrumental in improving the efficiency of our month/period close processes. Being able to tie the reconciliation report to the same location as the bank feed makes for an excellent high-level view into whether all accounts have been reconciled for a period. Knowing that a bank feed has been locked after reconciling it gives us confidence in information remaining accurate after we’ve completed our review too.” – Dan Quigley, Lead Accounting Technologist, Matax

“IT IS PERFECT!! This is what I have been waiting for! It is clean, intuitive and makes reconciling so much easier! I love how you kept it simple.” – Beta tester (US)

“Don’t [change anything]. I closed seven bank accounts in 25 minutes!” – Beta tester (US)

Our commitment to our US and Canadian customers

This new feature is another example of Xero’s commitment to addressing your specific needs in the US and Canada.

Looking beyond this release, we’ll soon add the ability for you to attach your PDF bank statement to your reconciliation. At a broader level, we’re committed to supercharging the bank reconciliation experience, making it as easy as possible to complete your bookkeeping, and giving you faster access to the valuable insights you need to manage your business.

Keen to try it out? We’re rolling out this feature to customers gradually over the next couple of weeks. Once available, you’ll find reconcile period as a new tab on the main reconciliation account page.

The post Close your books with confidence: Introducing reconcile period in Xero appeared first on Xero Blog.